Trading Results

Full SRP Historical Track Record History is online here CLICK TO VIEW

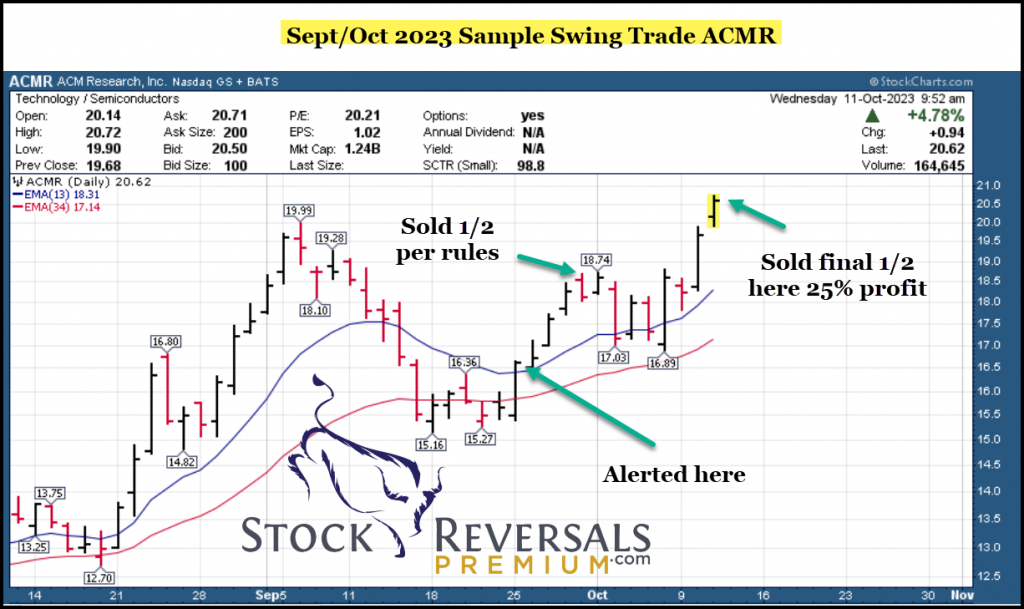

List of closed out Swing Trades in Chronological Order is below: Sample Oct 2023- ACMR 25% Gain

Disclosure: See disclosures at bottom of web page. All trading history results are based on our best assumed entry average price and assumed entry exit price. This is not a perfect system but gives you a broad idea of our overall results over long periods of time and in different bull and bear market conditions. Results are implied based on our alerts and rules for selling 1/2 a position and final closing of positions for either profits or losses. Positions are updated every morning in pre market with guidance updated as needed.

Historical Trading Results:

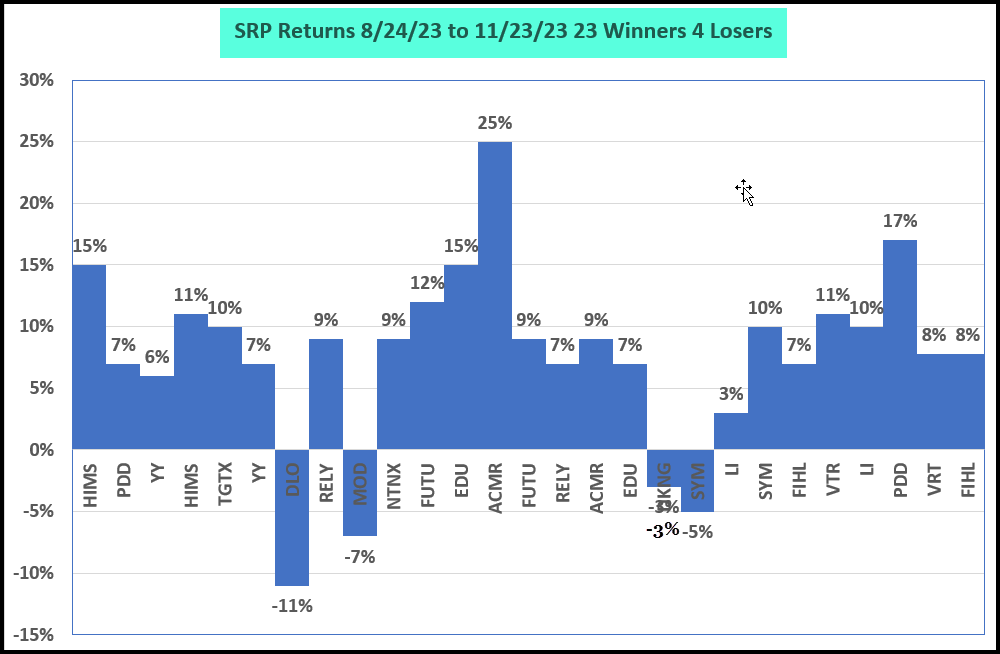

Recent Run from 8/24/23 to 10/13/23 during tough market

We frequently sell 1/2 at a time once we are up 6% plus, Every position is a 10% Allocation to start

We frequently sell 1/2 at a time once we are up 6% plus, Every position is a 10% Allocation to start

2024 Calendar Year to Date and Prior:

(2023 Correction was August-October, I use less positions during my confirmed downtrends)

2024 YTD

7/23- Sold 1/2 HALO 53 to 56.50 for 6% plus

7/18- Sold 1/2 TOST for 6-10% gains (25.250-27.80 highs)

7/15- Sold Final 1/2 ASTS for 22% Gains (11 to 13.50 target)

7/11- Sold 1/2 HIMS for 7% gains (21.25 to 22.70)

7/10- Stopped out final 1/2 APLD for 8% loss

6/27- Sold Final 1/2 NU for 12-14% gains (11.40 avg to 12.90 target hit)

6/26- Sold 1/2 APLD for 6-15% gains (6.25 to 7.23 highs)

6/14- Sold final 1/2 ENVX for 30% gains *10.55 to 13.70*

6/10- Sold 1/2 ENVX for 8-10% Gains (10.55 to 11.70 high)

6/10- Sold 1/2 PINS for 6-8% gains (41.25 to 44.10)

6/5- Sold FULL HALO for 15% gains (43.50 to 50.40)

6/4- Sold Final 1/2 SG for 15% plus Gains (30 to 35.xx)

6/1- Sold 1/2 SG for 6% Gains

5/16- Sold Final 1/2 VRT at 102.50 for 12% Gains (91.50 to 102.50)

5/15- Sold Final 1/2 CDLA for 22% gains *(9.50 max entry to 11.60)

5/14- Sold Final 1/2 ODD For 14% gains *(36.25 to 41.50)

5/13- Sold 1/2 ODD For 8-9% gains (36.25 to 39)

5/9- Sold 1/2 VRT for 6-7% gains (91.50 to 99.xx)

5/8- Sold 1/2 CADL for 10-12% gains (9.32/9.50 to 10.47)

5/8- Sold 1/2 PUBM For 6-7% Gains (23.40 to 25.10)

5/8- Sold Final 1/2 PUBM For 4% Loss

5/6- Sold 1/2 ALCT for 8-10% Gains *(14 to 15.40)

5/6- Sold Final 1/2 ALCT for 7% gains *(14 to 14.90)

4/30- Stopped out GCT for 11% Loss due to market correction

4/12- Sold Final 1/2 BZN for 5% Gains *18 to 18.90*

4/11- Stopped out final 1/2 FROG for 4% Loss (42.75 to 40.95)

4/4- Sold 1/2 BZN for 6-7% Gains *18 t0 19.25*

3/20- Sold Final 1/2 TBBB for 13% gains (20.50 to 23.25)

3/19- Sold 1/2 FROG for 8-10% Gains 42.50 to 46.50

3/15- Stopped out CFLT for 5-7% loss

3/15- Stopped out NET for 7% Loss

3/8- Sold Final 1/2 IOT for 18-19% Gains (33.25 to 39.50 plus)

3/6- Sold 1/2 TBBB for 7% plus gains (20.50 to 22.50 highs)

3/1- Stopped out DV from 41 to 31 on bad earnings (25% loss)

2/28- Stopped out Final 1/2 NXT for 3-4% gains (57 to 58.72)

2/28- Sold Final 1/2 PRCT for 4% gains

2/27- Stopped out INTA for 5-7% Loss

2/26- Sold 1/2 NXT for 7% plus gains *57 to 60-61.77 ranges

2/23- Sold final 1/2 GSIW at breakeven (13.50-13.50)

2/23- Stopped out TENB for 5% Loss

2/12- Sold 1/2 PRCT for 7% Gains (47 to 50.30)

2/13- Sold final 1/2 STNE for 5% loss

2/8- Sold Final 1/2 AFRM for 13% Gains (42.50 to 47.50)

2/8- Sold 1/2 AFRM for 7-8% Gains (42.50 to 45.80)

2/6- Sold 1/2 GSIW for 10-14% gains (13.50 to 15.50 high)

1/29- Stopped out Break Even on GCT final 1/2 of trade

1/29- Sold Final 1/2 S for 13% gains (24.40 to 27.75)

1/26- Sold 1/2 GCT for 9% Gains (22.50 to 24.75)

1/23- Stopped out CCL For 8% Loss

1/22- Sold 1/2 STNE for 6% gains (18.65 from 17.20 average)

1/22- Sold 1/2 S for 12% gains (24.40 to 27.60)

1/9- Sold GCT for 13% Gains *(22.30 to 25.40)

1/9- Sold Final 1/2 ALKT for 9% gains (22.70 to 24.75)

1/3- Stopped out BRZE for 5% Loss

1/4- Stopped out SYM for 8% Loss

1/4- Stopped out DT for break even

1/4- Sold HIMS for 3% gain on final 1/2

2023 and Prior

12/26- Sold Final 1/2 AMPH for 8% gains (57 to 62 plus)

12/19- Sold 1/2 CRSP for 6-7% Gains (60 to 64)

12/14- Sold Final 1/2 ARM for 12-13% gains *61.70 to 69.50

12/14- Sold LMND for 13% gains *18 to 20.30

12/13- Sold Final 1/2 ODD for 19% gains (34.50 to 41.30)

12/13- Sold 1/2 AMPH for 8% gains *57 to 62.xx*

12/8- Sold 1/2 ARM for 7% gains (61.70 to 66.10 3 days)

12/6- Sold 1/2 ALKT for 6% gains

12/6- Sold FRO for 10% Loss

12/4- Sold 1/2 ODD For 6-8% Gains (34-34.50 – 36.80)

12/1 – Sold Final 1/2 TGTX for 19% gains (10.50 to 12.50)

11/30- Sold ALL PINS for 8-10% Gains (31.40 to 34.80)

11/30- Sold IMGN For 83% gains 4 days (16 to 29.40) Bought out by ABBV

11/28- Sold Final 1/2 PDD for 25% gains (108 to 135 plus) Strong earnings breakout

11/22- Sold Final 1/2 HIMS for 15% Gains *6.90 to 8*

11/15- Sold 1/2 PDD for 7% plus *108 avg to 117 highs)

11/15- Closed Final 1/2 YY for 6-7% gains (39.50 to 43 at highs ,42.20 at alert time)

11/15- Sold 1/2 HIMS for 10-12% gains (6.95 average entry high of 7.90)

11/15- Sold 1/2 TGTX for for 10% plus gains (10.50 avg to 12.01 highs, 11.63 at alert time)

11/6- Sold 1/2 YY for 6-7% gains *39.50 to 42*

10/23- Stopped out DLO for 10%-12% Loss (Market was tanking hard)

10/19- Sold Final 1/2 RELY for 8-10% gains *25 to 27.30*

10/13- Sold MOD for 7% loss (48.10 to 44.85)

10/12- Sold Final 1/2 NTNX for 8-10% Gains (35.50 to 39)

10/12 Sold 1/2 NTNX For 8-10% Gains (35.50 to 39)

10/11- Sold Final 1/2 FUTU for 12% gains (59.50 to 67.10)

10/11- Sold Final 1/1 EDU for 15% gains (55.75 to 64.40)

10/11- Sold Final 1/2 ACMR for 25% Gains (16.50 to 20.65)

10/11- Sold 1/2 FUTU for 8-9% gains (64.75 from 59.50 2 days)

10/9- Sold 1/2 RELY for 7% gains (25 avg to 27)

9/30 – Sold 1/2 ACMR up 9%

9/27- Sold 1/2 EDU up 7% plus (55.75 to 59.75)

9/21- Stopped out final 1/2 DKNG for 2-3% Loss *29.75 to 28.86*

9/19- Stopped out FRSH for 7% Loss

9/8- Sold 1/2 DKNG for 6-7% (29.75 to 32 highs)

9/7- Stopped out Final 1/2 SYM for 5% Loss

9/5- Sold Final 1/2 LI for 3% Gains *38.50 to 39.81*

9/5- Sold 1/2 SYM for 10% gains (38.50 to 43)

8/31- Sold Final 1/2 FIHL for 7% gains (13.50 to 14.50)

8/31- Sold Final 1/2 VTR for 11% gains (34.50 to 39)

8/29- Sold 1/2 LI for 10% gains (*38.50 to 42.90)

8/29- Sold All of PDD For 17% gains (78.50 to 92)

8/24- Sold 1/2 VTR for 7.8% (34.50 max entry to 37.20)

8/24- Sold 1/2 FIHL for 7.8% (13.50 Avg entry to 14.80)

8/17- Stopped out RXRX for 20% Loss (11.70 avg to 9)

8/14- Closed Final 1/2 AUR for 12-13% Gains (3.18 to 3.61)

8/11- Sold 1/2 AUR for 6-7% gains *3.18 to 3.47*

8/8- Sold 1/2 ONON for 6% plus gains (34.75 to 37.xx)

8/8- Stopped out IOT for 10% Loss

7/27- Sold Final 1/2 LI for 14% (37 to 42.30)

7/20- Sold Final 1/2 IONQ for 13-14% (13.25 to 15.09)

7/20- Sold 1/2 LI for 7% (37 to 39.50)

7/14- Sold Final 1/2 CLFT 37.50 from 34.80 for 7.7% gains

7/13- Sold 1/2 CFLT at 37 area from 34.80 avg entry for 6% plus gains

7/12- Sold Final 1/2 FTDR 34.10 from 31.40 for 8.5% Gains

7/11- Sold Final 1/2 UPST at 43 area for 16% gains *(37.20 to 43.xx)

7/10- Sold 1/2 FTDR (33.28 high) from 31.40 for 6% Gains

7/6- Stopped out INTA for 20% loss

7/6- Stopped out FLYW For 7% Loss

7/6- Sold Final 1/2 GLBE for 17% Gains (43 from 37.20 avg)

7/3- Sold 1/2 UPST near 40 for 8-10% Gains

6/30- Sold 1/2 GLBE For 6% Gains

6/20- Stopped out final 1/2 UBER for 5% Gains (39.50 to 42.17)

6/20- Sold final 1/2 SDGR for 18% plus gains (40 max to 48.xx)

6/15- Sold 1/2 SDGR for 6-12% Gains (40 to 45.xx)

6/15- Sold 1/2 UBER for 6-8% gains (39.50 to 43.xx)

6/13- Sold 1/2 EVLV for 7% Gains *5.92 to 6.38*

6/9- Stopped out WULF for 7-10% loss

6/6- Sold All RELY for 8-10% Gains *18.20 to 19.90

6/6- Sold Final 1/2 DKNG for 10-12% Gains (23.20 to 26.20)

6/6- Sold Final 1/2 LI for 10-12% Gains (29.50 to 31.90)

6/6- Sold Final 1/2 LTH for 10-12% Gains (19.25 to 21.68)

6/1- Sold 1/2 DKNG For 6% gains (* 23. 20 to 24.80)

5/30- Sold 1/2 LI for 6-8% gains

5/30- Sold 1/2 LTH for 6-8% gains

5/22- Sold final 1/2 IAS for 12% avg gains (15.75 to 17.60)

5/22- Stopped out HIMS for 9% loss (10.50 to 9.50)

5/19- Stopped out PLX for 7% loss *(2.15 to 2.05)

5/16- Stopped out final 1/2 ONON for 6% loss

5/13- Stopped out WULF at 1.60 for small 2% loss on final 1/2

5/11- Sold 1/2 ONON For 6-7% Gains

5/5- Sold Final 1/2 DKNG for 13% Gains *(21.90 to 24.80)

5/5- Sold 1/2 DKNG for 8% gains *(21.90 to 23.62)

5/2- Sold 1/2 WULF at for 8-10% Gains (1.65 to 1.81)

4/26- Stopped out NXT for small 4-5% loss

4/26- Sold Final 1/2 PLX for 25-30% (2.05 to 2.60 plus)

4/24- Sold Final 1/2 OPRA for 9-11% gains (10.15-11.30)

4/21- Sold 1/2 GANX for 10-20% Gains (5 to 6.17 next day highs)

4/20- Final 1/2 CPRX closed for 3-4% gains (*16 to 16.47)

4/17- Sold all IOT for 7% gains

4/17- Stopped out final 1/2 ALGM For 3-4% loss

4/18- Sold 1/2 OPRA for 10% gains 10.15 to 11 to 11.30)

4/6- Sold 1/2 CPRX for 8-10% (15.70 to 17.20-17.30)

4/4- Stopped out final 1/2 RMBS For 10% gains (44.25 to 48.80)

4/4- Sold 1/2 PLX for 10% gains (2.05 avg entry to 2.25-2.30)

4/3- Stopped out BIVI for 20% loss (9.25 to 7.40)

3/29- Sold 1/2 RMBS for 6% plus gains (44.25 to 47.70)

2/28- Sold 1/2 RVNC for 6% plus gains

2/28- Sold 1/2 ARHS for 6% plus gains

2/7- Stopped out SHLS for 7% loss on final 1/2 (Profit on front 1/2)

2/6- Stopped out MODN For 10% Loss

2/2- Stopped out Final 1/2 ARRY for 7% Loss

2/2- Sold TOST full position for 8-9% gains *22.35 to 24.64 in 24 hours plus*

2/1- Sold 1/2 SHLS for 6% plus gains (26.50 to 28.40)

2/1- Sold Final 1/2 TGTX for 33% Gains (12.75 to 16.91)

1/24- Sold 1/2 TGTX up 11% (12.75 avg to 14.04)

1/24- Sold 1/2 ARRY up 7-8% (22.60 avg to 24.40)

1/13- Sold Final 1/2 AVXL up 11% *10 to 11.20*

1/11- Sold 1/2 AVXL up 6-8% (10 to 10.80)

1/10- Sold Final 1/2 TWI for 6% Gains *15.20 to 16.10)

1/10- Sold Final 1/2 CPRX for 7% gains *18.30-19.57

1/6- Sold 1/2 CPRX up 10% plus *18.30 avg to 20.50*

1/6- Sold 1/2 TWI for 6% plus gains (15.20 average to 16.30)

1/4- Stopped out HRMY final 1/2 for 5% loss

2022 Results:

12/23- Sold Final 1/2 BIVI 7.20 alert from 6.32 for 15% (low entry range was 5.85)

12/20- Sold 1/2 BIVI up as high as 15% from 6.32 alert to 7.20 same day

12/20- Stopped out PCSA at 1.68 from $1.80-2 entry for loss

12/16- Stopped out Final 1/2 CPRX for 3-4% Loss

12/15- Sold Final 1/2 ARRY at 23.75 alert for 13-14% Gains

12/14- Sold 1/2 ARRY 23.37 highs from 20.85 avg, 2 days for 11% (23 avg sell)

12/13- Sold 1/2 CPRX for 8% gains (16.60 avg entry to 17.70 avg)

12/13- Stopped out CCRN for 15% loss (33 to 28.70)

12/5- Stopped out PARR Final 1/2 for 7% Loss

12/1- Sold 1/2 HRMY for 6% plus at 60 (56-57 avg)

11/30- Sold FLEX for 11-12% (19.75 to 21.80)

11/24- Sold 1/2 PARR for 6% Gains (23.90 to 25.30)

11/9- Closed out ESTE and PERI for break even

11/8- Sold 1/2 BIVI for 10-15% gains (4-4.10 out at 4.55)

11/3- Stopped out final 1/2 DV for 10% Loss

10/27- Sold 1/2 ESTE for 8-10% (15.20 avg to high of 16.82)

10/27- Sold Final 1/2 CRBG for 7-8% Gains *22.80 from 20.75)

10/25- Sold 1/2 CRBG for 6% gains

10/25- Sold 1/2 DV for 9-10% Gains (31.30 up from 28.50 or lower avg)

10/19- Sold Final 1/2 BHVN at 12.13 alert for 12% or so avg gains (10.80 or lower avg)

10/19- Sold 1/2 BHVN at 11.60 for 7-8% gains

10/18- Sold Final 1/2 AMLX for 10-12% Gains (32.40 to 36.40)

10/18- Sold Full Position CPRX for 7-8% gains (12.30 to 13.20)

10/12- Sold Full Position KNBE due to buyout. 24.30 from 22 avg for 10-11% gains in 8 days

10/10- Sold 1/2 AMLX for 7% gains inside of 1st day of alert (32.40 to 35.30)

10/10- Stopped out LAZR for 20% Loss

9/13- Sold Final 1/2 CCRN for 12% gains (25 or lower to 27.70)

9/13- Sold Final 1/2 CPRX For 24% Gains (13.80 to 17.20)

9/12- Sold 1/2 MNTK for 10% gains (17.80 to 19.70) in 3 trading days

9/7- Sold 1/2 CPRX for 8% gains (13.80 to 14.80) in 3 trading days

8/25- Sold 1/2 CCRN for 8% plus gains at 27 plus (25 0r lower avg entry, 24 hours)

8/22- Stopped out GANX for 12% Loss

8/18- Sold Final 1/2 SIGA near 23 for final 4% gains

8/18- Sold Final 1/2 BVNRY for 6% Gains at 17.60

8/17- Stopped out HRMY for 11% Loss

8/11- Sold 1/2 SIGA For 8-10% gains (22 to 24.15 in 24 hours)

8/10- Stopped out EXEL for 9% Loss

8/3- Sold Final 1/2 VUZI at 8.80 alert from 7.55 entry for 16% Gains

8/3- Sold Final 1/2 IMXI at 24.80 alert from 21.50/21.75 entry for 13-15% Gains

8/2- Sold All of AHCO for 13% plus (20.65 to 23.80) on huge volume from Index add news

8/1- Sold 1/2 BVNRY for 8-9% gains 1 day later (17.80-18 from 16.40 avg)

7/29- Sold Entire RGP at 23 area for 10% plus profits (20.75 avg)

7/29- Sold 1/2 VUZI at 8.40 for 8-10% Profits (7.33 to 7.75 entry)

7/28- Sold 1/2 IMXI for 9-12% Gains (21.75 or lower avg to 24.25)

7/26- Stopped out CAL for 15% Loss on Walmart Earnings disappointment

7/18- Sold GO for 9-11% Gains (41.50 to 46)

7/11- Stopped out PDD for 12% loss

7/6- Sold Final 1/2 PRVA at 33.30 for 16% Gains

7/5- Sold 1/2 PRVA up as much as 18% from 28.75 avg entry (33.70)

6/17- Stopped out VTNR for 8% loss

6/13- Stopped out VUZI for 18% Loss (6.35 to 5.32) (Market washout)

6/13- Stopped out final 1/2 AG for 3% Loss *(8.20 to 7.94) We profited on front half 8-9%

6/6- Sold Final 1/2 VTNR for 18-20% gains (14.20 to 17)

6/2- Sold Final 1/2 AMD for 15% gains *(94.50 to 108.90)

6/2- Sold 1/2 AG for 8-9% Gains (*8.20 to 9.09)

5/31- Sold 1/2 AMD for 9-11% Gains (94-95 to 104.xx) 3 days

5/31- Sold 1/2 VTNR for 8-9% Gains (14.30 avg to 15.70 highs 2 days later)

5/25- Sold Final 1/2 VTNR for 7% Gains

5/17- Sold 1/2 TWI For 8-10% Gains

5/15- Sold 1/2 VTNR for 8-10% Gains

4/25- Stopped out WBM for 10% Loss

4/22- Sold 1/2 STER for 8-10% Gains

4/18- Sold Final 1/2 GOGL For 21% Gains (11.70 to 14.20)

4/14- Sold 1/2 GOGL for 12% Gains (11.70 to 13.10)

4/4- Stopped out GSL For 6% Loss

3/31- Sold Final 1/2 PLUG for 15% gains *25 to 29*

3/31- Stopped out Final 1/2 AMD for 5% loss (111 from 115/116 avg)

3/30- Sold 1/2 AMD for 8-9% gain (115 to 125) on double position size

3/23- Sold 1/2 PLUG for 15% gains *25 average to 29

3/15- Sold Final 1/2 ZIM for 18-19% Gains (*69 avg entry to 82.05 exit)

3/9- Sold 1/2 ZIM for 8-10% gains (*69 avg entry, 75-77 exit)

3/4- Stopped out AOSL for 10% loss

2/10- Sold Final 1/2 MARA for 19% gains (23.50 max to 28)

2/8- Stopped out Final 1/2 MTDR for 5% Loss

2/7- Sold 1/2 MARA for 9-12% gains (23.50 max buy to 26.40)

2/4- Sold 1/2 MTDR for 8% Gains (44.70 to 48.50)

2/1- Sold 1/2 ESTE For 9-10% Gains (12.75 to 14.30)

1/27- Sold out of FANG for 8-9% gains *(122 to 131-132)

1/18- Stopped out FLNG for 18% loss (Market mini crash)

1/18- Stopped out MP final 1/2 for 5% loss

1/12/22- Sold 1/2 MP for 8-9% Gains 24 hours (45.75/46 to 50.25)

1/5/22- Washed out of OLPX in market smash for loss of 15%

1/3/22- Sold 1/2 ON for 10% Gains (64.50 to 70)

2021:

12/27- Closed out Final 1/2 MANA.X Crypto for 10% Gains(3.30 to 3.65)

12/27- Sold 1/2 GDYN for 12-14% gains *(37.50 to 42.80 highs)

12/27- Closed out Final 1/2 SGH For 12% Gains (*62 or lower to 70)

12/27- Sold 1/2 AMN for 10% gains (116 to 128.75)

12/23- Sold 1/2 SGH For 8% gains

12/23- Sold 1/2 MANA.X (Crypto) for 8-9% gains same day (3.28-3.57)

12/20- Sold 1/2 EDR For 8% Final Gains (29.75 to 32.40)

12/16- Sold 1/2 EDR for 8-10% Gains *(29.75 to 33 highs of 12/16)

12/15- Stopped out Final 1/2 RBLX for 15% loss

12/10- Stopped out final 1/2 ZIM for 5% loss

12/9- Sold 1/2 RBLX for 8% gains

12/8- Sold 1/2 ZIM for 10% Gains 2 days (55.5o to 61.20)

12/3- Stopped out XPEV for 18% Loss on De listing concerns in China

12/1- Sold 1/2 AOSL for 10% Gains in 1 day

12/1- Stopped out Final 1/2 AOSL For 8% gains 1 day

11/19- Stopped out PTLO for 20% Loss post earnings

11/16- Stopped out BROS for 5% Loss

11/16- Stopped out final 1/2 TASK for 3% Gain

11/15- Sold 1/2 TASK For 10% Avg gains *(60-66)

11/10- Stopped out APPS for 5% average loss

11/9- Stopped out Final 1/2 CELH for break even

11/8- Sold Final 1/2 OLPX for 12% Gains (25-28.25)

11/5,8- Sold 1/2 CELH for 8% gains (99-108 avg)

11/2- Stopped out Final 1/2 ZI for 9% Gains

10/28- Stopped out Final 1/2 PGNY for 5% Gains

10/25- Sell 1/2 PGNY for 8-9% (58.50- 63.75)

10/21- Sell Final 1/2 JAMF for 15% gains (*40-46)

10/21- Sell 1/2 OLPX for 12% gains (25 to 28.25)

10/19- Sold 1/2 ZI for 8% Gains over 6 weeks

10/14- Sold 1/2 JAMF for 10% Gains (40 to 44)

10/13- Sold Final 1/2 INMD for 16% gains *70 to 82.50*

10/12- Sold 1/2 INMD for 10% Gains *70 to 77.50*

9/30- Stopped out RVLV for 10-11% Loss (69 to 61.77) in Market washout

9/29- Stopped out DLO for 9% Loss (62 to 56.68) in Market washout

9/28- Sold LKQ for 2% Gains

9/21- Sold Final 1/2 TPX for 10% Gains (43.75 to 48.25)

9/20- Stopped out AMD in market blood bath for 5% loss

9/10- Sold 1/2 TPX for 8-9% Gains

9/8- Sold final 1/2 KLIC for 12% Gains (64 to 72)

9/1- Sold Final 1/2 DOCS for 10% Gains (81.50- 90)

9/1- Sold 1/2 DOCS for 12% Gains (81.50 to 92 in 24 hours)

8/27- Sold 1/2 KLIC for 9% Gains (64 avg to 69.50)

8/20- Sold MUDS for 10% Loss as SPAC merger terminated unexpectedly

8/19- Sold Final 1/2 DLO for 36% gains from (50 to 68) in 4 days

8/18- Sold 1/2 DLO for 20% gains (*50 to 59.75) in 3.5 days

8/17- Sold Final 1/2 AMN for 11% Gains (98 to 108)

8/13- Stopped out GBOX for 15% Loss

8/12- Sold FULL FA for 14% gains (18.85 avg entry 21.60 exit, 22 days)

8/6- Sold Final 1/2 CRCT on Stop of $36 for 8% Gains

8/5- Stopped out DRVN for 7% Loss

8/5- Sold 1/2 AMN for 8% Gains

8/3- Sold 1/2 CRCT for 8% Gains

7/26- Stopped out Final 1/2 GLBE for 5% Profits

7/23- Sold 1/2 GLBE For 9% profits

7/16- Stopped out DKS For 5% Loss

7/16- Stopped out BKLE For 4% loss

7/14- Stopped out TASK For 13% Loss

7/13- Stopped out final 1/2 TRMR for 7% Gains

7/12- Sold 1/2 TRMR for 11-13% Gains (19.25 avg to 22.20)

7/8- Stopped out CDNA for 7% Loss

7/1- Sold Final 1/2 CELH for 6% Gains

6/29- Sold 1/2 CELH for 11% Gains

6/24- Sold Final 1/2 SEMR for 33% gains (17.75 avg entry to 23.75)

6/23- Sold Final 1/2 LOOP for 28% Gains (From Max 12.50 entry at 16 near close)

6/23- Sold 1/2 SEMR For 13% Gains (17.75 avg entry 20.18 avg exit)

6/23- Sold 1/2 LOOP for 35%-45% Gains (12.50 max entry to 16.70-17.50 ranges after Alert)

6/17- Stopped out UCTT For 10% loss

6/14- Sold Final 1/2 RIOT for 23% Gains (29.50-36.75)

6/10- Sold Final 1/2 YETI for 6.5%-8% Gains (84-86.70 to 91.70)

6/10- Sold Final 1/2 ASO for 14% Gains (35 to 39.90)

6/9- Sold 1/2 RIOT up 11% (29.50 to 32.50)

6/8- Sold 1/2 YETI For 8-10% (84-86.70 entry to 94)

6/8- Sold 1/2 ASO for 11-15% (35 to 39-40.50)

6/4- Sold 1/2 LOOP 50% *(8 to 12) in 11 weeks

6/4- Sold Final 1/2 QFIN for 25% Gains *( 28 to 35.xx) 8 days

6/1- Sold 1/2 QFIN for 14-15% gains (28 to 32.40) in 5 days

5/25- Sold CELH for 12-15% Gains on Full Position

5/18- Sold Final 1/2 LOVE for 10-11% Gains

5/14- Sold 1/2 LOVE for 8% Gains

5/13- Sold Final 1/2 CLF for 19% Gains

5/5- Sold 1/2 CLF for 8% Plus Gains

5/3- Stopped out QFIN for 2-3% Loss on Final 1/2

5/4- Stopped out SOS for 7% Loss

4/30- Sold Final 1/2 GRBK for 8% Gains

4/28- Sold Final 1/2 CRCT for 14% Gains

4/27- Sold 1/2 QFIN for 8% gains

4/26- Sold 1/2 CRCT for 14% Gains

4/25- Sold 1/2 GRBK for 9% Gains

4/16- Stopped out PINS for 10% Loss

4/16- Stopped out final 1/2 APPS for 7% Loss

4/13- Sold 1/2 APPS for 8-9% Gains

4/11- Stopped out final 1/2 BLNK for 7% Loss

4/9- Solf Final 1/2 INMD for 14% Gains

4/8- Sold 1/2 BLNK for 8-9% Gains

4/1- Sold 1/2 INMD for 8-9% Gains

3/26- Sold All ICHR for 8% Gains

3/24- Stopped out Final 1/2 LHDX for 15% Loss

3/19- Sold final 1/2 HOME for 17% Gains

3/16- Sold 1/2 LHDX For 8-10% Gains

3/12- Sold 1/2 HOME for 8% gains

2/25- Stopped out SWAV for 10% Loss in market washout

2/24- Sold final 1/2 PLX for 5-7% Gains

2/23- Sold 1/2 PLX For 8-9% Gains

2/22- Stopped out NTLA for 7% Loss

2/22- Sold Final 1/2 HZO for 8% Gains

2/22- Sold Final 1/2 ZNGA for 5% Gains

2/18- Sold 1/2 HZO for 11% Gains (16 days)

2/17- Sold Final 1/2 PLBY For 20% Gains

2/15- Sold Final 1/2 PCRX for 10% Gains

2/11- Stopped out ATHA for 15% Loss

2/11- Sold 1/2 ZNGA for 8% plus gains 1 day later

2/10- Sold 1/2 PCRX for 9% Gains

2/9- Sold final 1/2 HOLX for 7% Gains

2/8- Sold 1/2 PLBY for 9-10% in 4 days

2/8- Sold Final 1/2 ENLV for 65% in 5 Days

2/4- Sold 1/2 ENLV for 15% Gains in 3 days

2/1- Sold 1/2 HOLX up 9%

1/28- SCPL stopped out break even or a small loss

1/27- Market washout stopped us out of CHGG, LAC, AMD for 5-12% Losses

1/21- Sold Final 1/2 DM for 11-12% Gains

1/20- Sold final 1/2 APPS for 18-20% gains in 8 days

1/15- Sold final 1/2 LOVE for 15% Gains

1/14- Sold 1/2 DM for 9% gains on day 1

1/14- Sold 1/2 APPS for 9-10% gains in a few days

1/14- Sold final 1/2 INMD for 19% gains in 8 days

1/12/21- Sold 1/2 INMD for 9% Gains in 6 days

1/11/21- Sold Full TFFP for 15% Avg Gains

1/8/21- Sold Final 1/2 MARA for 100% Gains in 8 days

1/7/21- Sold 1/2 LOVE for 10% Gains

1/6/21- Sold Final 1/2 VIPS For 12% Gains

1/5/21- Sold 1/2 MARA for 8-10% Gains

Dec 2020 and prior:

12/30- Sold 1/2 VIPS for 9-10% Gains

12/28- Stopped out final 1/2 VBIV for 11% Loss

12/28- Stopped out CGC for 7% Loss

12/22- Sold 1/2 VBIV for 8% gains

12/16- Sold final 1/2 TRIT for 18% Gains

12/14- Sold final 1/2 PRVB for 12% Gains

12/15- Stopped out INO for 10% Loss on Final 1/2 (Made 10-15% plus on Front half)

12/4- Stopped out RKT for 8% Loss

12/4- Sold Final 1/2 PINS for 7-8% Gain

12/4- Sold 1/2 TRIT for 8-10% Gains 3 days later, TRITW up 40%

12/3- Sold 1/2 INO for 10%-15% Gains 1 day later

12/1- Sold Final 1/2 YETI For 7-8% Gains

12/1- Sold Final 1/2 APPS for 15% Gains

11/30- Sold 1/2 APPS for 9% Gains (4 days)

11/27- Sold 1/2 PINS for 8-9% Gains (4 days)

11/27- Sold 1/2 PRVB for 9% Gains (16 days)

11/23- Sold 1/2 YETI for 9-10 Gains

11/19- Sold Final 1/2 CVAC for 28% Gains

11/16- Stopped out MWK for 15% Loss

11/15- Sold 1/2 TFFP for 15% gains

11/12- Sold Final 1/2 TRIT for 18% gains

11/12- Sold 1/2 CVAC for 16% Gains (3 days)

11/10- Sold 1/2 NFIN for 8-10% Gains (11.19)

11/9- Sold Final 1/2 FSR for 18-20% (13.45) Day 2

11/9- Sold final 1/2 CGC for 18-20% gains, day 2

11/9- Sold 1/2 FSR for 8-12% Gains, day 5

11/6- Sold 1/2 CGC for 9-11% gains on day 1

11/6- Sold 1/2 SDC for 8-9% Gains

11/5- Sold 1/2 SDC for 10% plus gains

10/30- Stopped out TFFP for 30% Loss

10/27- Sold ETON for 6-8% Gains

10/27- Sold Final 1/2 GME for 5-7% Loss

10/27- Sold final 1/2 LTRN for 15% Loss

10/22- Sold 1/2 GME For 8%-12% Gains

10/20- Sold HZNP for 2% Loss

10/20- Sold Final 1/2 INMD for 2-3% Gains

10/13- Sold 1/2 INMD for 14-20% Gains (Pre market alert was 20%)

10/12- Sold 1/2 LTRN for 15-20% Gains

10/6- Sold 1/2 SCPL for 8-9% Gains

10/5- Sold Final 1/2 INMB For Break Even

10/1- Sold Final 1/2 SAIL for 20% Gains

9/30- Sold 1/2 SAIL for 9-10% Gains

9/23- Sold Final 1/2 TFFP for 28% Gains

9/23- Stopped out DOYU for 10% Loss

9/18- Sold 1/2 INMB for 8-12% Gains

9/16- Sold 1/2 TFFP for 8-9% Gains

9/14- Sold Final 1/2 ETON For 17% Gains

9/8- Stopped out ATOM for 15% loss

9/8- Sold Full Position VIRT for 7% -10% average gains

9/4- Stopped out RESN for 8% Loss on Final 1/2

9/1- Sold 1/2 ETON for 8% Gains

8/30- Sold final 1/2 TFFP for 20% plus Gains

8/31- Sold Final 1/2 DOYU for 13% Gains

8/28- Sold 1/2 MWK for 8-9% Gains

8/27- Sold 1/2 TFFP for 14% Gains 1 day after alert

8/26- Sold 1/2 DOYU for 8-9% Gains

8/21- Sold Final 1/2 RKT for 19% Gains 2 days after alert

8/21- Sold Final 1/2 MWK for 28-34% Gains

8/20- Sold 1/2 RKT for 12% Gains 1 day later

8/19- Sold Full CWH for 7-8% gains

8/19- Sold Final 1/2 CRBP for 13-15% Gains

8/18- Sold 1/2 RESN for 8-13% gains

8/18- Sold 1/2 CRBP for 8-11% Gains

8/17- Sold 1/2 MWK for 18% Gains

8/13- Sold AZEK for 6% Profits 1 day after alert

8/11- Stopped out VUZI for 15% loss

8/6- Stopped out SPCE for 15% Loss

8/5- Sold Final 1/2 NARI for 20% gains

8/4- Sold 1/2 NARI for 9% Gains

8/4- Sold 1/2 RESN for 8-13% Gains

8/3- Solf Final 1/2 HYRE for 14% Gains

7/29- Sold Final 1/2 TFFP for 15%

7/29- Sold 1/2 HYRE for 12% Gains

7/28- Stopped out NFINW for 30% Loss

7/28- Stopped out TBIO for 15% Loss

7/28- Sold 1/2 TFFP on spike for 30-40% Gains

7/22- Sold Final 1/2 CHGG for 7-8% Gains

7/22- Sold AAXN for 7% average loss

7/22- Sold final 1/2 VUZI for 9-11% gains

7/21- Sold 1/2 VUZI for 13% Gains

7/10- Sold 1/2 CHGG for 10% Gains

6/30- Sold final 1/2 CATS for 22% Gains

6/29- Sold final 1/2 ATOM for 5-8% loss

6/26- Sold final 1/2 INVA for Break Even

6/24- Sold final 1/2 CORT for 11% Gains

6/24- Sold final 1/2 PRVB for 8% Gains

6/22- Sold 1/2 CORT for 10% Gains

6/22- Sold 1/2 ATOM for 8-10% Gains

6/19- Sold 1/2 PRVB for 8-10% Gains

6/17- Sold 1/2 CATS for 8-10% Avg Gains

6/12- Sold final 1/2 FMCI for 10% Gains

6/12- Stopped out ONEM for 10% Loss

6/11- Stopped out Final 1/2 BLDP for break even

6/11- Stopped out GAN for 10% Loss

6/11- Stopped out ATOM for 10% Loss

6/10- Sold 1/2 BLDP for 9% plus gains

6/8- Sold 1/2 FMCI for 8% gains

6/8- Sold EOLS for 10-15% Gains

6/5- Stopped out BCRX near close for 17% Loss

5/28- Sold Final 1/2 GAN for 20% Gains

5/26- Sold 1/2 GAN for 8-9% Gains

5/22- Sold Final 1/2 ATOM for 14% plus gains

5/21- Sold Final 1/2 SNDX for 17% Loss (7-10% gains on front half)

5/20- Sold 1/2 ATOM for 7-10% gains

5/19- Sold 1/2 SNDX for 7-10% Gains

5/13- Sold Final 1/2 DRV for 15% Gains

5/13- Sold 1/2 DRV for 14% Gains

5/12- Sold Final 1/2 BCRX for 57% Gains

5/12- Sold Final 1/2 GAN for 13% Gains

5/11- Sold 1/2 GAN for 9% Gains

5/5- Sold Final 1/2 PTON for 13% Gains

5/5- Sold 1/2 BCRX for 9-13% Gains

5/4- Sold 1/2 PTON for 8% Gains

5/1- Stopped out VIR for 10% Loss

5/1- Stopped out SLGG for 23% Loss

4/29- Sold 1/2 PGNY for 11% Gains (3 days)

4/29- Sold Final 1/2 UBER for 10% Gains

4/28- Sold Final 1/2 LITE for 9% gains

4/28- Sold final 1/2 SDGR for 9% Gains

4/28- Sold 1/2 UBER for 8% Gains

4/27- Sold Final 1/2 VIR for 17% Gains (10 days)

4/27- Sold Final 1/2 AXSM for 30% Gains in 3 days

4/27- Sold 1/2 AXSM for 50% gains in 3 days

4/27- Sold 1/2 SDGR for 15% Gains in 3 days

4/23- Sold final 1/2 SOLY for 16% Gains

4/20- Sold final 1/2 FVRR for 18% Gains

4/20- Sold 1/2 FVRR for 12% Gains

4/17- Sold Final 1/2 DOCU for 9% Gains

4/17- Sold Final 1/2 ZS for 13% Gains

4/15- Sold 1/2 ZS for 8% Gains

4/14- Sold 1/2 SOLY for 8-10% Gains

4/14- Sold 1/2 DOCU for 8% Gains

4/14- Sold Final 1/2 VTIQ for 13% Gains

4/13- Sold 1/2 VTIQ for 11% Gains

4/9- Sold TZA for 16% Loss, took it on as Hedge for market

4/8- Sold Final 1/2 CHWY for 12% Gains

4/8- Sold 1/2 CHWY for 8% gains

4/7- Sold final 1/2 DEAC for 10% Gains

4/7- Sold 1/2 DEAC for 13% Gains

4/2- Sold GSX for 12% Loss (Tanked on LK Fraud News non related)

4/1- Sold LK for 5% Loss

3/27- Sold DOCU for 6% Gains

3/25- Sold Final 1/2 UBER for 23% Gains

3/25- Sold Final 1/2 PRVB for 7% Gains

3/24- Sold 1/2 PRVB For 7-8% gains

3/24- Sold 1/2 UBER for 17% gains

3/23-Sold SPXS for 7% Gains

3/19- Sold final 1/2 ZM for 17% Gains

3/17- Sold 1/2 ZM for 8-9% Gains

3/4- Sold LABU for Break Even

2/28- Stopped out final 1/2 VBIV for 20% loss (made 8-10% on front half) (Market Crash week)

2/28- Sold Final 1/2 ZTO for 5% gains

2/23- Stopped out PRVB for 17% Loss (Market was crashing)

2/20- Sold PING for 12-13% Gains

2/12- Sold 1/2 ZTO for 7-8% Gains

2/12- Sold Final 1/2 BLDP for 14% Gains

2/12- Sold 1/2 VBIV for 8-10% Gains

2/5 – Stopped out final 1/2 INMD for 3% Gains

2/5- Sold 1/2 BLDP for 9-11% Gains

2/4- Sold 1/2 INMD for 9-10% Gains

1/27- Stopped out SI for 8-10% Loss

1/24- Sold Final 1/2 RDFN for 27% Gains

1/24- Sold Final 1/2 STNE for 7-8% Gains

1/23- Sold 1/2 STNE for 10% Gains

1/10- Sold Final 1/2 LX for 12% Gains

1/10- Sold final 1/2 CDLX for 17% Gains

1/2- Sold 1/2 LX for 8-10% Gains

12/27- Sold MOMO for 10% Loss

12/27- Sold 1/2 CDLX for 10% Gains

12/23- Sold Full SOLY for 3-5% gains

12/12- Sold final 1/2 PRVB for 10% gains

12/12- Sold 1/2 LTHM for 10-14% Gains

12/9- Sold 1/2 RDFN for 8% gains

12/6- Sold 1/2 PRVB for 10-11% Gains

11/27- Stopped out final 1/2 FLGT for 2-3% Gains

11/26- Stopped out final 1/2 STNE for 11% Gains

11/22- Sold 1/2 STNE for 10% Gains

11/20- Sold 1/2 FLGT for 10-12% Gains

11/14- Sold Final 1/2 GH For 11-12% Gains

11/13- Sold final 1/2 WB for 5-7% Loss

11/12- Sold 1/2 GH for 8% gains

11/8- Sold Final 1/2 MTZ for 8% Gains

11/5- Sold 1/2 MTZ for 9-10% Gains

11/4- Sold 1/2 WB for 8-9% Gains

11/1- Stopped out SEDG for 10% Loss

10/30- Sold Final 1/2 GSX for 17% Gains

10/28- Sold 1/2 GSX for 9% Gains

10/18- Sold DOCU for 2% Gains

10/16- Sold OPRT for 10-17% gains

10/15- Sold final 1/2 INMD for 7% Gains (Hit profit stop)

10/14- Sold 1/2 INMD for 10% Gains

9/22- Stopped out SOLY for 8% Loss

9/18- Stopped out IOTS for 15% Loss on Share offering

9/17- Sold final 1/2 SOLY for 15% Gains

9/17- Stopped out final 1/2 FNKO for 5% gains

9/17- Stopped out HYRE for 10% Loss

9/13- Sold Final 1/2 WB for 7% Gains

9/11- Sold 1/2 FNKO for 8-9% Gains

9/9- Sold 1/2 WB for 8-9% Gains

9/6- Sold 1/2 SOLY for 5-8% Gains

9/4- Sold final 1/2 GSX for 4-5% Gains

8/29- Sold 1/2 GSX for 8-9% Gains

8/28- Stopped out GH for 10% Loss

8/21- Sold 1/2 GSX for 16-18% Avg Gains

8/16- Stopped out LK for 7% loss

8/14- Stopped out Final 1/2 GSX for Break Even

8/11- Sold 1/2 GSX for 12% Gains

8/6- Stopped out GH for Break Even on Final 1/2

8/6- Stopped out ADPT for 5-7% Loss

8/2- Sold final 1/2 PRVB for 5-7% Loss

7/29 Sold ZM for Break Even on final 1/2

7/26 Sold TWTR for 9-10% Avg Gains

7/16- Sold 1/2 PRVB for 13-15% Gains

7/16- Sold 1/2 GH for 11% Gains

7/15- Sold Final 1/2 SE for 12-14% Gains

7/8- Stopped out FNKO for 7-8% loss

7/7- Stopped out YCBD for 10% Loss

7/8- Stopped out NEO for 7-8% Loss

6/21- Sold final 1/2 SNAP for 18% Gains

6/21- Sold 1/2 SE for 11% Gains

6/18- Sold Final 1/2 PINS for 12% Gains

6/10- Sold Final 1/2 GH for 22% Gains

6/7- Sold 1/2 PINS for 9% Gains

6/7- Sold final 1/2 TNA for 8% Gains

6/6- Sold 1/2 SNAP for 9%-10% Gains

6/5- Sold 1/2 TNA ETF for 8-9% Gains

6/4- Sold 1/2 GH for 10-11% Gains

6/3- Stopped out SMAR for 7% loss

5/30- Stopped out XBIT for 20% Loss

5/23- Sold 1/2 SE for 17-20% gains

5/24- Sold Final 1/2 SE for 17-18% Gains

5/23- Stopped out TNDM for 4% loss

5/22- Stopped out GH for 7% loss

5/22: Sold 1/2 SE for 17%-20% Gains

5/9: Stopped out CTK for 10% Loss

5/7: Stopped out SVVTF for 15% loss

5/8: Stopped out final 1/2 YCBD for 10% Loss

5/7: Sold 1/2 YCBD on 8% sell rule for 15-20% gains (7.23 high from 6.05 avg entry with low of 5.70)

4/30: Sold final 1/2 EB for 15% Gains

4/30: Sold Final 1/2 I for 8% gains

4/26: Sold 1/2 I for 9-11% Gains

4/24: Sold 1/2 EB for 8-9% Gains

4/18: Stopped out FHL for 10% loss

4/18: Sold final 1/2 VIOT for 35% gains

4/17: Sold 1/2 VIOT for 22% gains

4/13: Stopped out HYRE for 12% loss

4/5: Stopped out NBEV for 8% Loss

3/26: Stopped out OSTK for 13% Loss

3/21 Stopped out MOGU for 11% Loss

3/20 Stopped out IQ for 9% Loss

3/22 Stopped out EOLS for 14% Loss

3/13: Sold Final 1/2 HYRE for 36% Gains

3/12: Sold 1/2 HYRE for 14% Avg Gains

3/8: Stopped out CURLF for 14% Loss

3/8: Stopped out TBLT for 23% Loss

3/4: Sold Final 1/2 ENPH for 14% Avg Gains

2/27: Stopped out final 1/2 AAC for 7% Gains

2/27: Sold 1/2 ENPH for 11-13% Gains

2/26: Stopped out WTRH for 12% Loss

2/21: Stopped out Break Even on INOV Final 1/2

2/19/19: Sold 1/2 AAC for 20-23% Gains

2/19/19: Stopped out CTK for 23% Loss

2/15/19: Sold 1/2 INOV for 8-10% Gains

2/6/19: Sold Final 1/2 NBEV for 7-8% Gains

2/3/19: Stopped out TBLT for 15% Loss

1/30/19: Sold 1/2 NBEV for 12% gains

1/28/19: Sold Final 1/2 IQ for 8-9% Gains

1/25/19: Sold 1/2 IQ for 8-10% Gains

1/23/19: Sold 1/2 EOLS up 6-8%

1/16/19: Sold Final 1/2 ZLAB for 12% Avg Gains

1/14/19: Sold Final 1/2 EXPI for 23-30% Gains

1/11/19: Sold 1/2 ZLAB for 8-12% Gains

1/10/19: Sold 1/2 EXPI for 14% avg gains

1/8/19: Sold Final 1/2 MRIN for 20-23% Gains (1 day)

1/8/19: Sold 1/2 MRIN for 9-12% Gains

1/7/19: Sold final 1/2 NBEV for 6-7% Gains

1/7/19: Sold final 1/2 ROKU for 24% Gains

1/3/19: Sold 1/2 NBEV for 12% Gains

1/3/19: Sold Final 1/2 TNA for 6% Gains

1/2/19: Sold 1/2 TNA ETF for 13% Gains

1/2/19: Sold 1/2 ROKU for 8% gains

12/13: Stopped out NIU for 15% Loss

12/27: Stopped out TME for 8% loss

12/28: Stopped out CRON for 12% Loss

12/10: Sold Final 1/2 NBEV for 7% Gains

12/10: Sold final 1/2 NTNX for Break Even plus

12/10: Sold Full EB for 6% plus avg gains

12/7: Stopped out GOOS for 10-13% Loss

12/3: Sold 1/2 NBEV for 10-16% Gains

11/30: Sold 1/2 SVMK for 8-9% Gains

11/20: Sold Final 1/2 YETI for 6% Gains

11/19: Sold 1/2 YETI for 7-9% Gains

11/15: Stopped out LABU for 15% loss

11/8: Sold Final 1/2 EB for 14% Gains

11/7: Sold Final 1/2 TNA for 16% Gains

11/7: Sold 1/2 EB for 8-9% Gains

11/6: Sold 1/2 LTHM for 7-9% Gains

11/1: Sold 1/2 TNA For 9-10% Gains

10/23 Week: Stopped out of BABA for 5% loss

10/23 Week: Stopped out ROKU for 3-5% loss intra-day stop

10/23 Week: Stopped out LABU at 62 near close for 10-13% Loss on avg

10/12: Stopped out VUZI for 7-8% Loss

10/8: Stopped out ZUO for 6% Loss

10/8: Stopped out IRBT for 8% Loss

10/8: Sold Final 1/2 GOGO for 5% gains

10/4: Sold 1/2 GOGO for 8-10% Gains

9/27: Sold Final 1/2 I for 23% gains

9/26: Sold 1/2 I for 13% Gains

9/24: Stopped out BILI for 8% loss

9/17: Sold final 1/2 SAIL for 5-7% Gains

9/13: Sold Final 1/2 MTCH for 16% Gains

9/11: Sold 1/2 MTCH for 8% gains

9/10: Sold 1/2 SAIL for 7-8% Gains

9/3: Stopped out Final 1/2 TWTR for 3% Loss

9/6: Sold Final 1/2 MEDP for 2% Gains (Stop was 58)

9/4: Sold 1/2 MEDP for 7-9% Gains

8/30: Stopped out ESIO for 3-4% Loss

8/28: Sold Final 1/2 ROKU for 13% Gains

8/27: Sold 1/2 TWTR for 8% Gains

8/23: Sold 1/2 ROKU for 8% Gains

8/23: Sold Final 1/2 FNKO for 15-18% Gains

8/21: Sold 1/2 FNKO for 8-10% Gains

8/17: Sold Final 1/2 CGC for 9-10% Gains

8/16: Sold 1/2 CGC for 5% gains

8/16: Stopped out LABU for 7% Loss

8/15: Sold PETQ for 16-19% Gains

8/14: Stopped out IQ for 7% Loss

8/10: Stopped out MU for 7% Loss

8/9: Sold Final 1/2 I for 15-16% Gains

8/7: Sold 1/2 I for 10-12% Gains

7/30: Stopped out ZTO for 7% Loss

7/25: Stopped out CRSP for 12% Loss

7/25: Stopped out UXIN for 10% Loss

7/9: Stopped out ZUO for 6-7% Loss

7/6: Stopped out SUPN for 10-12% Loss

7/5: Sold Final 1/2 SFIX for 8% Gains

7/5: Sold RUN for 7-8% Gains

6/25: Stopped out HMI for 5-7% Loss

6/21: Sold 1/2 SFIX for 15-16% Gains

6/14: Stopped out GNK for 11% Loss

6/14: Sold Final 1/2 DBX for 17-20% Gains

6/14: Sold 1/2 DBX for 14%-17% Gains

6/13: Sold Final 1/2 HMI for 30-35% Gains

6/11: Sold 1/2 HMI for 15-20% Gains

6/7: Sold Final 1/2 SGH for 8-11% Gains

6/5: Sold 1/2 SGH for 7-9% Gains

6/4: Stopped out IBKR for 5% Loss

6/1: Sold Final 1/2 LABU for 12% Gains

5/31: Sold 1/2 LABU for 10-12% Gains

5/30: Sold Final 1/2 ZTO For 15-17% gains

5/25: Sold 1/2 ZTO for 7-8% Gains

5/24: Stopped out CPE for 6-8% Loss

5/22: Stopped out KEM for 7% Loss

5/23: Sold ONE for 13-15% Gains in 24 hours

5/22: Sold final 1/2 PSTG for 7-9% Gains

5/17: Stopped out NUGT for 6-8% Loss

5/14: Stopped out VUZI for 10-12% Loss

5/10: Sold 1/2 PSTG for 8% Gains

5/10: Sold final 1/2 IQ for 20-25% Gains

5/10: Sold 1/2 IQ for 8-11% Gains

5/8: Sold final 1/2 AKAO for 2-4% Gains

5/3: Stopped out LABU for 5% Loss

5/1: Sold ANGI for 5% Loss

4/30: Sold 1/2 AKAO for 14% Gains

4/21: Sold Final 1/2 CLDR for 14-17% Gains

4/18: Sold 1/2 CLDR for 12% Gains

4/13: Stopped out PPDF for 10% Loss

4/13: Sold Final 1/2 IQ for 17% Gains

4/12: Sold 1/2 IQ for 11-14% Gains

3/13: Sold Full PPDF for 13% Gains

3/13: Sold Final 1/2 QD for 17% Gains

3/13: Sold Final 1/2 LABU for 20% Gains

3/8: Sold Final 1/2 NTLA for 24% Gains

3/8: Sold 1/2 QD For 15% Gains

3/8: Sold 1/2 LABU for 10% Gains

3/7: Sold 1/2 NTLA for 10-14% gains

3/2: Stopped out LABU for 6% Loss if Conservative

2/8: Sold final 1/2 VUZI for 34% Gains

2/6: Stopped out SUPN for 10% loss

2/2- Stopped out final 1/2 SRAX for 20% Loss (18% gain on front half)

2/1- Stopped out SOGO for 15% loss

1/31- Stopped out RESN for 25% Loss

1/26- Sold Final 1/2 AYX for 11-15% Gains

1/25- Sold 1/2 AYX for 11-15% Gains

1/25- Sold JT for 30-35% Gains on Full Position

1/25- Sold Final 1/2 EXTR for 13% Avg Gains

1/23- Sold 1/2 EXTR for 13% Avg Gains

1/16- Sold Final 1/ CORT for 12-15% Gains

1/11- Sold 1/2 CORT for 8-14% Gains

1/8- Sold ICHR for 9% Gains

1/8- Sold 1/2 VUZI for 33-38% Gains

1/8- Sold 1/2 XRAX for 13-20% Gains

12/19- Sold KTOS for 8-13% Gains

12/13- Sold final 1/2 JT for 32-42% Gains

12/13- Sold 1/2 JT for 21-30% Gains

12/13- Stopped out SQ for 5-7% Loss

12/5- Stopped out 1/2 LABU for 4-5% Loss

12/4- Sold 1/2 LABU ETF for 10-11% Gains

12/1- Stopped out XRF for 25% Loss

12/1- Stopped out SOGO for 15% Loss

11/28- Sold Final 1/2 FNKO for 7-14% Gains

11/28: Sold Final 1/2 SFIX for 40% Gains

11/28- Sold Final 1/2 WUBA for 12% Gains

11/27: Sold 1/2 FNKO for 5-14% Gains

11/27- Sold 1/2 SFIX for 14-16% Gains

11/21: Sold 1/2 WUBA for 14% Gains

11/16: Sold final 1/2 YY for 17% Gains

11/15: Sold 1/2 YY for 12% Gains

11/14: Stopped out LABU for 7-8% Loss

11/9: Sold Full IOTS for 7-12% Gains

11/8: Sold final 1/2 NTNX for 19% Gains

11/3: Stopped out NUGT ETF for 4% Loss

11/2: Sold Final 1/2 SEDG for 13% Gains

11/1: Sold MLCO for 10% Gains

10/31: Sold 1/2 SEDG for 16% Gains

10/27- Sold final 1/2 OSTK for 31% Gains

10/25- Stopped out WB for 8% Loss

10/25- Stopped out JD for 3% Loss

10/24- Sold 1/2 OSTK for 15-17%% Gains

10/17- Sold Final 1/2 KEM for 18% Gains

10/11- Sold 1/2 NTNX for 12-14% Gains

10/11- Sold All KTOS for 8-9% Gains

10/9-Sold 1/2 KEM for average 11-13% Gains

10/6- Sold 1/2 LABU for 16-17% Gains

10/6- Stopped out NBEV for 17% Loss

10/2- Sold 1/2 LABU ETF for 14% Gains

9/25 Stopped out WUBA for 11% Loss

9/25- Sold final 1/2 YY for 10% Gains

9/21- Sold EA For 1-2% Gains

9/15- Sold final 1/2 PETQ for 10% Gains

9/11- Stopped out BGNE for Break Even on final 1/2

9/8-Sold 1/2 YY for 14% Gains

9/6- Sold 1/2 BGNE for 11% Avg Gains

9/6- Sold Final 1/2 MOMO for 9% Gains

8/30- Sold 1/2 MOMO for 12% Gains in 2 days

8/30- Stopped out UBNT for 8% Loss

8/25- Sold 1/2 PETQ for 14-16% gains at 26.85 alert

8/17- Stopped out TTD for 8% Loss

8/15- Stopped out SRPT for 5% avg loss

8/8- Sold final 1/2 JD for 18% Gains

8/7- Sold YRD for 11-18% Gains

8/3- Stopped out SWIR for 20% Loss

8/2- Sold MDC for break even

7/27- Stopped out final 1/2 NTNX for 13% gains

7/27- Stopped out final 1/2 LABU for 2-4% Gains

7/26- Sold 1/2 JD for 11% Gains

7/25- Sold Final 1/2 BIVV for 16% Gains

7/25- Sold Final 1/2 YY for 24% Gains

7/18- Sold 1/2 NTNX for 20% Gains

7/17- Sold 1/2 YY for 15-17% Gains

6/27- Stopped out CAMT for 10% Loss

6/27- Stopped out SINA for 5% Loss

6/26- Sold Final 1/2 Z for 12% Gains

6/23- Sold 1/2 TWLO for 15-17% Avg Gains

6/21- Sold 1/2 TWLO for 10-11% Gains

6/21- Sold 1/2 Z for 7% Gains

6/20- Sold final 1/2 LABU for 19% Gains

6/19- Sold 1/2 BIVV for 12% Gains

6/19- Sold 1/2 TWLO for 12% Gains

6/15- Stopped out MOMO for 8% Loss

6/15- Stopped out CMCM final 1/2 for 4% loss

6/13- Sold 1/2 LABU for 7-8% Gains

6/12- Stopped out final 1/2 MKSI for 4% Loss

6/12- Stopped out TTWO for 6% Loss

6/8- Sold 1/2 MKSI for 8-10% Gains

6/2- Sold Final 1/2 GOOS for 20% Gains

6/1- Sold 1/2 CMCM for 8-10% Gains

6/1- Sold 1/2 GOOS for 8-10% Gains

5/30-Stopped out LABU ETF for 10% Loss on 1/2 position or 5% equivalent

5/24- Stopped out DY for 15% Loss

5/19- Stopped out ESNT at 35.90 for 3-4% Loss

5/18- Sold ATHM for 11-13% Gains near $42

5/17- Stopped out OCLR for 5% Loss

5/16- Stopped out VRAY for 15-20% Loss

5/10- Sold Final 1/2 TDOC for 20-23% Gains

5/10- Stopped out Final 1/2 AQMS for 23% Loss

5/8- Sold 1/2 AQMS for 5-8% Gains

5/4- Sold PCRX for Breakeven to 3% Gains

5/3- Stopped out GTN for 10% Loss

5/3- Stopped out NUGT for 4-7% Loss

5/1- Sold 1/2 LABU for 17% Gains

4/25- Sold 1/2 LABU for 11% Gains

4/25- Sold final 1/2 JD for 9% Gains

4/21- Stopped out FRAC for 10% Loss on Full Size

4/20- Sold Final 1/2 TLND for 5-6% Gains on Full Size

4/20- Sold 1/2 JD for 5-7% Gains on Full Size

4/18- Stopped out final 1/2 NUGT for 7% Loss on 1/2 size

4/13- Sold 1/2 NUGT for 7-11% Gains on 1/2 size

4/4- Sold 1/2 TLND for 7-9% Gains on Full Position Size

4/3- Sold Final 1/2 FUEL for 30-35% Gains on Full Position Size

3/28- Sold BABA for 3-5% Gains on Full Position Size

3/24- Sold 1/2 FUEL for 20-24% Gains on Full Position Size

3/24- Sold Final 1/2 TRVG for 3-5% Gains

3/23- Sold 1/2 TRVG for 5-6% Gains

3/21- Stopped out Final 1/2 YIN for final 12% Gains

3/21- Stopped out for 14% Loss on LABU 5% Position Size

3/16- Sold 1/2 YIN for 15-22% Gains on 10% Position Size

3/16- Sold NUGT for 8-10% Gains on 5% Position Size

3/2- Sold UBNT for 2% Loss

3/2- Sold WLL for 3% Loss

2/28- Sold Final 1/2 FAS ETF for 6% Gains

2/24- Sold 1/2 FAS ETF for 6% gains

2/22- Sold Final 1/2 MOMO for 17% Gains

2/15- Sold Final 1/2 TDOC for 6% Gains

2/15- Sold Final 1/2 IDCC for 6% Gains

2/14- Sold AMAT for 6% Gains on 10% Position Size

2/14- Sold TRN for Break Even on 10% Position Size

2/13- Sold 1/2 TDOC For 8-11% Gains on 10% Position Size

2/13- Sold 1/2 MOMO for 10% Gains on 10% Position Size

2/13- Sold 1/2 IDCC for 6% Gains on 10% Position Size

2/8- Sold 1/2 Final AG for 9% Avg Gains on 10% Position Size

2/8- Sold NUAN for 2-3% Gains on 10% Position Size

2/7- Sold 1/2 AG for 10% Avg Gains on 10% Position Size

2/6- Sold 1/2 LABU for 16% Gains on 5% Position Size

2/1- Sold 1/2 LABU for 12% Avg Gains on 5% Position Size

1/30- Stopped out ERX ETF for 6% loss on 1/2 size position (3% equivalent loss)

1/30 Sold Final 1/2 TTD for 8% Gains on Full Position Size

1/25- Sold 1/2 TTD for 9% Gains on Full Position Size

1/25- Sold final 1/2 EDC ETF for 9.5% Gains

1/24- Sold 1/2 EDC ETF for 8% Gains

1/24/19- Stopped out LABU initial 5% entry size at $34 for 4-5% loss, re-entered at 35.09 same day

1/19- Sold FNMA for 5-7% Gains on 5% Position

1/18- Sold 1/2 NUGT for 8-11% Gains to close out

1/17- Sold 1/2 NUGT for 13% Gains on 5% Position Size

1/11- Sold Final 1/2 LABU for 15% Gains on Full Position Size

1/9- Sold 1/2 LABU for 12-14% Gains on Full Position Size (2 days)

1/7- Stopped out LIVE for 15% Loss on 1/2 Size Position (7.5% Equivalent)

12/30- Stopped out OPK for 18% Loss

12/28- Stopped out SNCR for 7% Loss on 1/2 Position Size *3.5% equivalent loss*

12/21- Sold ALGN for 5% Average Gains on Full Position

12/15- Stopped out MOMO for 15% Loss for Aggressives, 8% for Conservatives

12/7- Sold Final 1/2 NUGT for 10% Gains

12/7- Sold 1/2 VALE for 12% Gains on 10% Position

12/6- Sold 1/2 NUGT for 8.5% Avg Gains

11/30- Sold Final 1/2 ACIA for 3% Gains

11/30- Sold Final 1/2 STMP for 6% Gains

11/23- Stopped out LABU for 5% Loss

11/16- Sold 1/2 ACIA for 13% Gains in 2 days

11/15- Sold 1/2 NUGT for 14% gains in 1 day

11/15- Sold CWH for 7%-8% Gains on 5% Position Size

11/2- Sold Final 1/2 NUGT for 19% Gains

11/1- Sold AQMS for 10-12% Gains on 10% Position (3 months)

11/1- Sold 1/2 NUGT for 9-11% Gains on 10% Position

10/31- Sold MOMO for 8% Gains on final 1/2

10/27- Stopped out LABU for 7% Loss

10/25- Stopped out ACIA for 5% Loss

10/19- Stopped out LN for 6% Loss on 10% Position

10/19- Sold 1/2 NUGT for 22% Gains

10/13- Sold 1/2 NUGT for 10% Gains on 5% Position Size

10/12- Stopped out ACIU for 8% Loss on 10% Position

10/10- Sold 1/2 MOMO for 18% Gains on 10% Position

10/7- Sold LGIH for 7% loss on 10% Position

10/3- Sold Final 1/2 CEMP for 3-5% Gains on Full Position

9/28- Sold Final 1/2 YRD for 25% Avg Gains on 10% Position Size (12 days)

9/27- Sold 1/2 YRD for 13% Avg Gains on 10% Position Size (11 days)

9/23- Sold Final 1/2 IRWD for 17% Avg Gains on 10% Position Size

9/21- Sold 1/2 IRWD for 13-15% Avg Gains on 10% Position Size *8 weeks

9/19- Sold Final 1/2 TCMD for 25-28% Gains on 5% Position Size

9/15- Sold 1/2 TCMD for 19% Avg Gains on 5% Position Size

9/14- Sold 1/2 CEMP for 9.5% Avg Gains on 10% Full Position Size

9/14- Sold AHS for 4% Loss on Full Position

9/8- Sold Final 1/2 LABU ETF for 12% Gains on 5% Position Size- 2 Days

9/7- Sold 1/2 LABU ETF for 9%-10% Gains on 5% position size- 1 Day

8/24- Sold URI for 5% gains on Full Position Size

8/24- Sold HZNP for 3-4% Gains on Full Position Size

8/24- Sold Final 1/2 MOMO for 30% Gains on Full Position (8 days)

8/23- Sold 1/2 MOMO for 16-20% Gains on Full Position (1 week hold)

8/23- Sold MBLY for 9-11% Gains on original 1/2 Position Size (3 weeks)

8/19- Stopped out of PCRX for 5-6% Loss on 1/2 Position Size (equivalent to 2.5-3% loss)

8/16- Sold Final 1/2 PI for 17% Gains on Full Position (2 week Hold)

8/15- Sold 1/2 PI for 14% Gains on Full Position (2 week hold)

8/2- Sold Final 1/2 EXAS for 9-10% Gains on Full Position

8/1- Sold 1/2 EXAS for 11-12% Gains on Full Position

7/27- Sold Final 1/2 VUZI for 8% Gains on 1/2 Position Size (5% Equivalent)

7/26- Sold Final 1/2 LABU ETF for 16% Gains on Full Position

7/26- Sold Final 1/2 NERV for 15% Gains on Full Position

7/25- Sold 1/2 VUZI for 18% Gains on 1/2 Position Size (5% equivalent)

7/21- Sold 1/2 LABU for 13% Gains on Full Position

[/vc_column_text][/vc_column][/vc_row]